A lot of elements need to be taken into consideration, some of which include tax rules, tax responsibilities, and other matters that impact the family. High-net-worth individuals have several priorities, including preserving their descendants' inheritances, reducing the amount of estate tax they must pay, staying out of the need for a probate proceeding, and selecting the most qualified trustee. But how can you successfully manage this intricate process? This essay will serve as a concise guide to helping you lay out your estate.

Minimizing Estate Taxes

The first order of business is to ensure that you have hired someone to take care of your requirements for estate planning. Regrettably, some members of the professional community do not put their customers' needs first in their work. They could choose a path that offers them the most potential for money rather than offering suggestions that would lower your expenses and ensure that the assets in question are transferred to the appropriate parties. But how can you determine whether or not you can put your faith in your trustee? Carry out some study and look for a person willing to work for and with your requirements. Make it a point to talk to the individual you pick to represent you about all of your wishes for estate planning, as well as to ask them questions, seek out reviews, and read them. Consider using the information provided here as a jumping-off point in your search for an attorney or trustee specializing in estate planning.

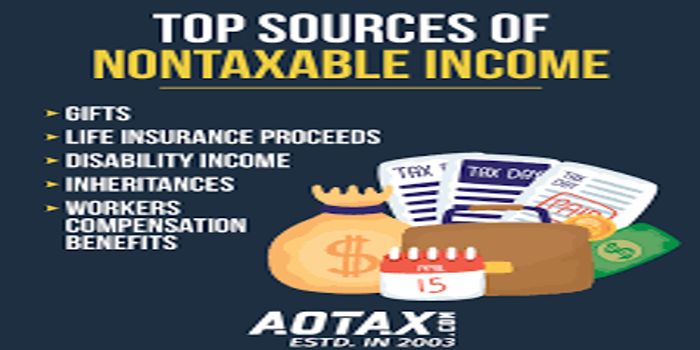

One of the numerous aspirations of working people is to acquire riches for themselves and their loved ones so that they may leave something to them after they are gone. However, doing so often results in a cost being incurred. There is the matter of taxes, which might reduce the value of your estate if you do not make the appropriate decisions. During the process of planning your estate, you should take into account all possible tax situations. This covers taxes on income, gifts, estates, generation-skipping transfers, and traditional taxes. For any tax category within a given group, the proportion of the value of whatever is being measured that is attributable to federal taxes is forty percent (40%).

Gift and Estate Taxes

Generally, annual adjustments are made to account for gift and estate taxes inflation. However, the passage of the Tax Cuts and Jobs Act (TCJA) in 2017 doubled the exemption for gift and estate taxes, which are referred to as a unified credit. This occurred in its entirety.

The same principles apply to estate taxes, but the exemption amount of $11.7 million for estate taxes in 2021 is lowered by the value of the gifts given during a person's lifetime. Therefore, if you provided gifts totaling $3 million under the lifetime gift tax exemption, your estate tax exemption will now be $8.7 million because of these contributions.

Generation-Skipping Transfer Taxes

When a grandchild or great-grandchild inherits property, the current owner is responsible for paying generation-skipping transfer taxes. You are responsible for paying tax equal to forty percent of the gift(s) amount, and you are allowed a tax exemption of up to eleven and a half million dollars in 2021 and twelve and a half million dollars in 2022. In case you were wondering, the reason for this tax is to prevent grantors, who are the people who create trusts, from skipping the following generation to avoid paying taxes.

Incapacitation Planning

If you worked hard your whole life to put money up for your retirement and leave a legacy to your children, you would be incensed if that money was lost or diminished. Let's avoid that circumstance. You want to make sure that, if you become unable to care for yourself due to age, a disease, or an accident throughout your lifetime, you can:

- Provide care for dependents

- Put someone on the board.

- Ensure that your property is managed in an orderly manner. Indicate how you would want to be treated at the end of your life if you are in a vegetative state permanently.

You must ensure that specific actions are carried out to achieve these objectives.

- Appoint a power of attorney that is enduring (POA). After you cannot care for yourself, the agent named in this kind of POA can handle any financial, legal, and property-related concerns on your behalf. You can assure that your agent will be able to handle your bank accounts, purchase and sell property, manage other assets, and read your mail if you follow these steps.

- Think about getting a power of attorney for medical care (HCPA). With the help of this document, your agent can make decisions on medical treatment.